Introduction

The global flat steel market plays a foundational role in numerous industries, including construction, automotive, shipbuilding, and appliances. Its versatility, durability, and recyclability make it an essential material in modern infrastructure and manufacturing. As global economies focus on urbanization, industrialization, and sustainable practices, the demand for flat steel is expected to grow steadily over the next decade.

This article provides a detailed overview of the flat steel market, including key trends, market drivers, segment analysis, regional performance, challenges, and future projections through 2033.

Market Overview

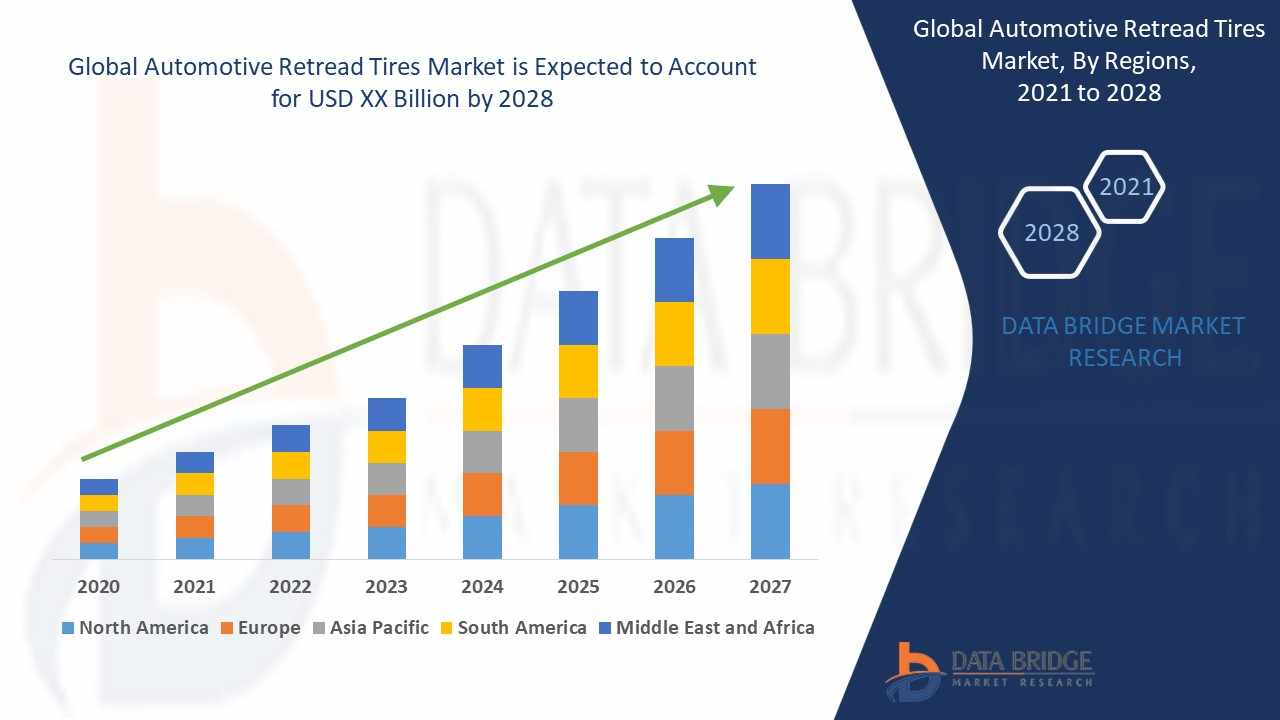

Flat steel refers to products that are rolled from steel slabs and include hot-rolled sheets, cold-rolled sheets, coated steel, and plate steel. In 2024, the global flat steel market was valued at approximately USD 750 billion and is projected to surpass USD 1,100 billion by 2033, growing at a compound annual growth rate (CAGR) of around 4.5%.

Factors such as infrastructure development, automotive production, and renewable energy investments are major contributors to this growth. Additionally, innovations in steel production processes and rising demand for high-strength, lightweight steel are shaping the market landscape.

Key Market Drivers

Rising Infrastructure Development

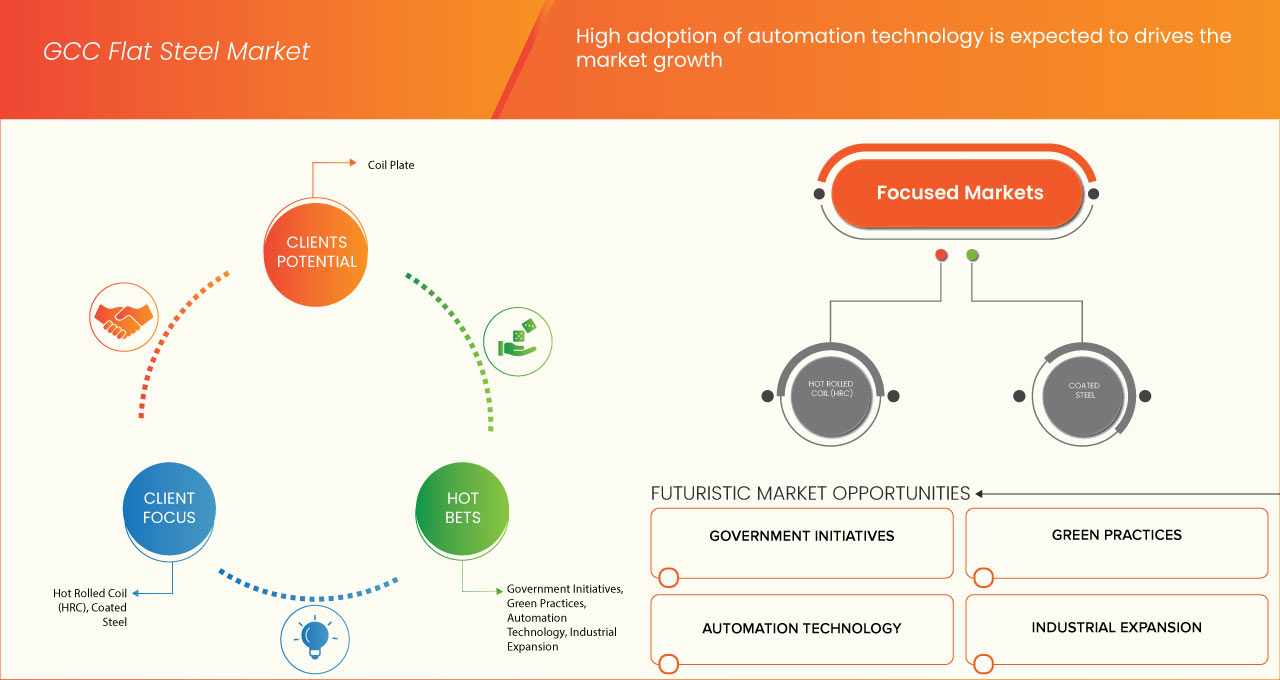

Expanding construction activity in both residential and commercial sectors, especially in emerging economies, drives flat steel demand for beams, structural supports, and reinforcement.Automotive Industry Expansion

Flat steel is a primary component in vehicle bodies, chassis, and engine parts. The increasing production of electric vehicles (EVs) and lightweight vehicles continues to support market growth.Growth in Renewable Energy Projects

Wind turbines, solar panels, and hydroelectric systems rely on strong and corrosion-resistant steel components, pushing the demand for flat steel in energy infrastructure.Technological Advancements in Steel Manufacturing

Modern techniques such as electric arc furnaces (EAF) and direct reduced iron (DRI) production reduce energy use and emissions, aligning with sustainable manufacturing goals and encouraging broader adoption.Recyclability and Circular Economy Trends

Steel's recyclability supports circular economy models, leading to higher usage of recycled steel in flat products without compromising strength or quality.

Market Segmentation

By Product Type

Hot-Rolled Steel

Cold-Rolled Steel

Coated Steel (Galvanized, Color-Coated)

Plate Steel

By Material

Carbon Steel

Alloy Steel

Stainless Steel

By End-Use Industry

Construction & Infrastructure

Automotive

Mechanical Equipment

Energy & Power

Appliances

Shipbuilding

By Distribution Channel

Direct Sales

Distributors & Traders

Regional Insights

Asia-Pacific

Asia-Pacific holds the largest market share, with China, India, Japan, and South Korea being key contributors. Rapid urban development, industrial growth, and large-scale government investments in infrastructure projects are the main growth factors.North America

The U.S. and Canada see strong demand in the automotive, construction, and energy sectors. The push toward clean energy and green buildings supports long-term flat steel usage.Europe

Europe is a mature market focusing on producing eco-friendly and high-performance steel. Automotive manufacturing and infrastructure renovations continue to sustain regional demand.Latin America

Brazil and Mexico are the dominant markets due to investments in public infrastructure, construction, and heavy machinery industries.Middle East & Africa

Increasing industrialization, oil and gas projects, and urbanization initiatives in the Gulf nations and South Africa are expanding the need for flat steel.

Technological Trends

Green Steel Production

Steelmakers are investing in carbon-neutral technologies using hydrogen-based production to reduce carbon emissions and meet regulatory targets.Advanced Coatings and Treatments

Improved corrosion resistance and thermal performance through advanced coatings are expanding the use of flat steel in harsh environments.Automation and AI Integration

Smart manufacturing and AI-powered quality control systems are optimizing production efficiency and reducing waste.Digital Supply Chains

Digitization is transforming the flat steel supply chain, enhancing logistics, inventory management, and transparency across stakeholders.

Market Challenges

Volatile Raw Material Prices

Fluctuating costs of iron ore and coking coal directly impact steel production margins and pricing strategies.Environmental Regulations

Stringent emissions and energy consumption standards in steel production can limit traditional methods and increase operational costs.Global Trade Tensions

Tariffs, import-export restrictions, and geopolitical issues affect the supply-demand balance in the global flat steel market.Overcapacity and Competition

Excess production in some regions leads to pricing pressures and reduced profitability for manufacturers.

Competitive Landscape

Leading companies are focusing on capacity expansion, product diversification, and green technology to gain competitive advantages. Prominent players include:

ArcelorMittal

Nippon Steel Corporation

Tata Steel

POSCO

JFE Steel Corporation

Thyssenkrupp AG

United States Steel Corporation

Baosteel Group

JSW Steel

Nucor Corporation

Future Outlook (2025–2033)

The flat steel market is expected to continue its growth trajectory through 2033, driven by the following factors:

Strong demand in the construction and automotive sectors

Emphasis on sustainable and low-carbon steel production

Expansion in emerging economies

Integration of digital technologies in steel manufacturing

Increasing investment in smart cities and clean energy infrastructure

Source: https://www.databridgemarketresearch.com/reports/global-flat-steel-market

Conclusion

The global flat steel market is poised for steady growth fueled by its indispensable role in infrastructure, transportation, and manufacturing. While challenges such as environmental compliance and price volatility persist, the market’s evolution toward sustainable practices and advanced technologies offers long-term opportunities. Stakeholders that innovate, invest in green technologies, and adapt to shifting demand dynamics will be well-positioned to thrive in the years ahead.

Write a comment ...